Simmons Bank Foundation Visa®

Building credit starts with a strong foundation.

The Simmons Bank Foundation Visa® credit card is designed to help establish and strengthen your credit.

There's something for everyone.

Whether you want to upgrade your tech or plan your next getaway, it’s easy to earn points on your day-to-day spending, and then redeem them for something you love.

Card alerts

Turn your card on and off and receive email notifications when your card is used in a way that could indicate fraud.{16}

Travel coverage

Get up to $1,000,000 in travel accident insurance at no additional cost.{22}

Investment and Insurance Products are: Not FDIC Insured | Not Insured by Any Federal Government Agency | Not a Deposit or Other Obligation of, or Guaranteed By, Simmons Bank or Any of Its Affiliates | May Go Down in Value

Easy checkouts

Use the secure EMV microchip or load your card onto a digital wallet like Apple Pay® Google Pay™ or Visa Checkout®.{87}

Car rental coverage

Get coverage for damage due to collision or theft up to the actual cash value of most rental cars.{22}

Investment and Insurance Products are: Not FDIC Insured | Not Insured by Any Federal Government Agency | Not a Deposit or Other Obligation of, or Guaranteed By, Simmons Bank or Any of Its Affiliates | May Go Down in Value

Global acceptance

Use your card anywhere Visa is accepted for purchases, 24-hour cash from ATMs and cash advances.

At your service

24-hour customer service representatives are always there to help.

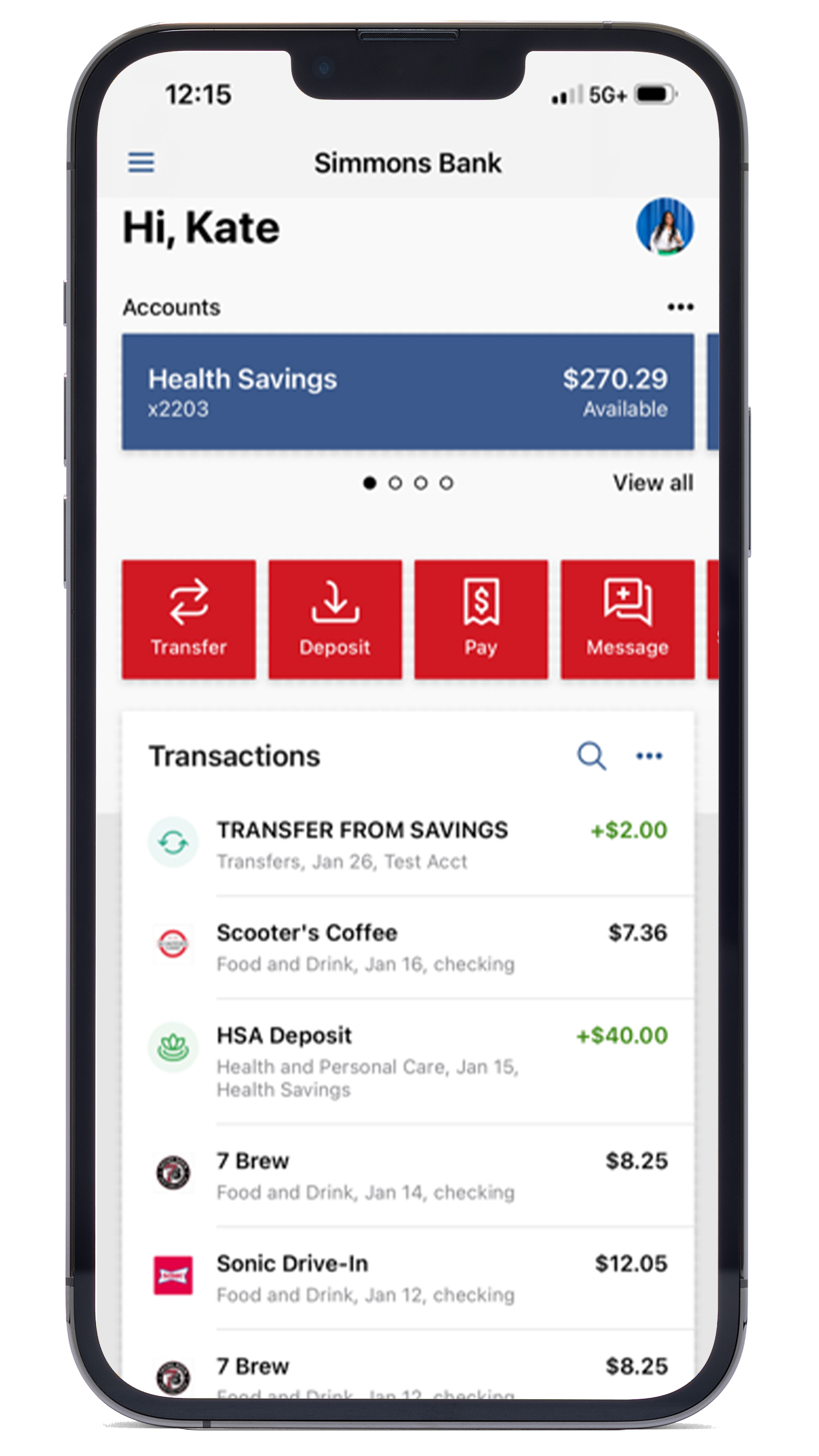

Manage your finances in one place.

Too many apps? Manage your banking and credit card accounts from the same dashboard on any device with Simmons Bank Online & Mobile.{16}

Simmons Bank Online & Mobile

- Check your statements

- Transfer funds

- Deposit checks

- Manage and pay bills

- Set up card alerts

- Access business services

Get all of these features and more when you sign up!

Simmons Bank Foundation Visa® Card FAQs:

The Simmons Bank Foundation Visa is a secured credit card. The card’s credit limit is equal to the amount deposited in the Foundation Secured Savings Account when opening the card. The credit limit can range from $300 to $5,000.

After making your deposit and determining your credit line, you can now make purchases on your card. Every month, you’ll receive a credit card statement that lists what you spent, your balance and the amount due. Your initial deposit doesn’t cover your statement balance; you must make separate payments for the amount due each month.

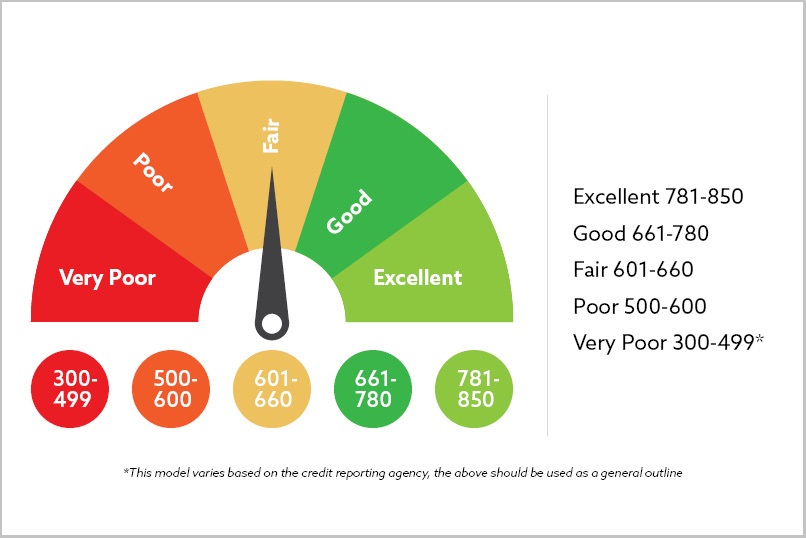

When you spend with your card and pay your bills, that activity is reported to the three major credit bureaus. An important factor that goes into your credit score is your payment history (your track record of paying bills on time). So, with consistent, responsible use of your Foundation Visa card, you could see your credit improve over time.

The Foundation Secured Savings Account should only be used to secure the deposit. It cannot be used in the same way as a traditional savings account in regard to deposits, withdrawals or transfers while the Foundation Visa card is active.

After a year of responsible usage with the Foundation Visa, you could be eligible for an upgrade. Contact a representative at 1-800-272-2102 to learn more.

Yes, our Simmons Bank credit cards can be added to your mobile wallet and used to pay anywhere Apple Pay, Google Pay or Visa Checkout is accepted.

You can make a payment on your account by calling 1-800-272-2102 or digitally through our app.

-

{188} Annual Percentage Rate (APR) accurate as of January 28, 2026. All APRs are variable. Account subject to credit approval. Variable APR of 26.49%. Cash Advance APR of 27.49%. Cash Advance Fee is the greater of $4 or 3% of the transaction amount. Foreign Transaction Fee of 2% of each transaction, in US Dollars. See the Credit Card Agreement for account terms.

-

{272} As part of the application process for a Simmons Bank Foundation credit card account, you must open a Foundation Secured Savings Account. If your credit card application is not approved, we will convert the savings account or otherwise return or credit the funds in it to you.

-

{16} Data connection required. Wireless carrier fees may apply. Mobile deposit is available to Simmons Bank online and mobile banking customers who are at least 18 years of age and have the most recent Simmons Bank App for iPhone®, iPad®, or Android™.

-

{22} Certain terms, conditions and exclusions apply. In order for coverage to apply, you must use your covered Visa card to secure transactions. Please refer to your Guide to Benefits for Simmons Visa or Guide to Benefits for Simmons Rewards Visa Signature for further details. Not a Deposit | Not FDIC Insured | Not Insured by any Federal Government Agency | May Lose Value | Not Bank Guaranteed

-

{87} Contactless payment applies only to Simmons Visa debit and credit cards. The contactless symbol and contactless indicator are trademarks owned by and used with permission of EMVCo, LLC.

-

{159} To request a copy of credit card agreements and disclosures, please call 1-800-272-2102 or fill out the Credit Card contact form.

-

{271} iPhone, iPad, Apple, the Apple logo, Apple Pay, and the Apple Pay logo are trademarks of Apple Inc. Android, the Android Logo, Google Pay, and the Google Pay logo are trademarks of Google Inc. Samsung, the Samsung logo, Samsung Pay, and the Samsung Pay logo are trademarks of Samsung Electronics Co., Ltd.