Coin Checking + Savings

Your money. Your move.

Start your journey with Coin Checking and Coin Savings. Earn extra interest by simply using your debit card.

- $0 Minimum Balance to Open{181}

- $0 Monthly Service Charge

Have questions? Learn more

Earn with Coin Savings.

Grow your money by linking Coin Checking with Coin Savings — our digital savings account that rewards you for using your debit card.

Earn 0.25%{201} over our current rates on the first $10,000 of your Coin Savings account balance when you:

- Make 15+ purchases with your Coin Checking debit card that post each month

Earn 0.50%{201} over our current rates on the first $10,000 of your Coin Savings account balance when you also:

- Have at least $500 in monthly direct deposits or any other ACH deposits, into your Coin Checking account each month

Already have a Coin Checking account? Add a Coin Savings account here.

![]()

Get your paycheck early.

With Early Payday, direct deposits may be posted to your account up to 2 days early!{213}

There’s no fee and no need to sign up.

Don't have direct deposit? No problem! Download this form and submit to your employer, to request to get started.

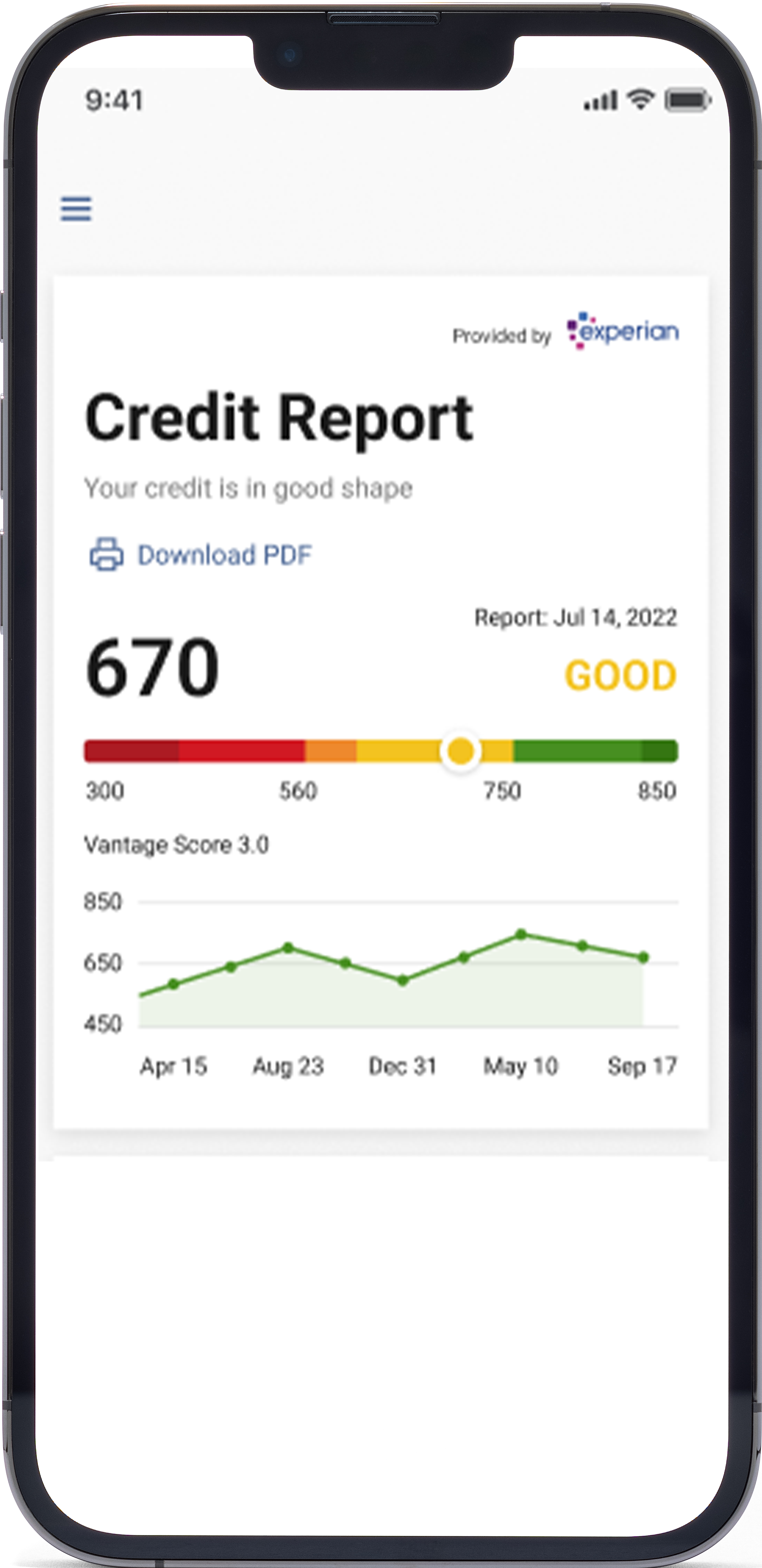

Manage your credit score.

A great credit score helps you do a lot more.

Our tool makes it simple and easy to view your score, get personalized insights and better understand your credit.

Round up your purchases to the next whole dollar amount and we'll deposit the difference in a second account of your choice.{21}

32,000+ ATMs

Make cash withdrawals and check your account balance at more than 32,000 MoneyPass ATMs with no surcharge fee.

Mobile Deposit

Deposit checks from your smartphone or tablet anytime, anywhere with no charge.{16}

Coin Checking FAQs:

There is no monthly service charge on this account. However, there is a $3 Paper Statement Fee each statement cycle you receive a paper statement. If you receive eStatements instead of paper statements, this fee is not assessed.

One thing that makes Coin Checking unique is the 45-day funding window. This means you can open an account today and fund the account whenever is convenient for you. For example, if you need a new account to sign up for direct deposit at your work, but you won’t get paid for two weeks, this is the perfect account for you!

You will typically receive your debit card in 5-10 business days from the date we verify your physical address.

Digital account opening is limited to individual account owners and does not currently allow for adding joint owners during the online account opening process. However, you can add joint owners and beneficiaries by visiting one of our branch locations.

Beneficiaries can also be added during the online account opening process. To add a beneficiary, you will need to provide the person's name, address, SSN, DOB and phone number.

Yes! Once your Coin Checking account is open, our branch associates will treat the account like any other account and will be happy to help.

If you are already a Simmons Bank customer, once you click the “Open Now” button, you’ll see an option to log in with your online banking credentials, or by entering your last name, last 4 of your social, account number and account type. When you select one of these options, we’ll pre-fill your application making the process faster.

The best account opening experience is with your mobile device. For that, we recommend using your mobile device and the native browser for your operating system (i.e., Safari for iPhone and Chrome for Android). For desktop account opening, we recommend using Google Chrome or Microsoft Edge.

Because we are not face-to-face, scanning your ID and selfie is our attempt at making eye contact like in-person friends. We need to see your state-issued ID to make sure you are who you say you are. Turns out robots do not have IDs.

Additionally, we ask for your ID to prevent fraudsters from attempting to open an account.

We understand that technology can sometimes be a pain.

- Be steady when framing your ID in the predefined window.

- Find a well-lit area with natural light. For your selfie, face the light to avoid shadows.

- Find a neutral background and eliminate any clutter that might get in the way.

- Make sure you have a good connectivity to ensure the images upload and process efficiently.

Yes! We're big fans of Zelle. If you're not using that service yet, you can enroll here, after your Coin Checking account is opened.

You will need your government-issued ID or driver's license, your Social Security Number (SSN) and a mobile device with a camera. You will be required to take a live selfie. It's important to us and to our fraud department.

Nope. 😊 There's no minimum deposit required to open the account. However, we do need at least $0.01 deposited into the account within the first 45 days of account opening. Otherwise, we'll take it to mean you changed your mind and close the account on day 46 if it still has a zero balance.

Deposits will be made available in accordance with our funds availability policy and may be available immediately or several days later. For specific questions on each deposit method, please call customer service at 1-866-246-2400.

No. Coin Checking is designed for those who prefer digital banking. However, if you need to purchase checks, you can do so by visiting any Simmons Bank branch.

You must be at least 18 years old.

Yes! Just add your Simmons Bank card to your smartphone and you're good to go!

You should only send money to those you know and trust, not strangers. And if a deal sounds suspicious or too good to be true, it probably is. Payment scams are prevalent these days with the convenience of digital banking. Stay safe by knowing where your money is going!

-

{165} All accounts subject to approval. Restrictions apply.

-

{97} Benefits and features are subject to customer qualification and approval by Simmons Bank.

-

{7} Simmons Bank Debit Card issuance is subject to customer qualification and approval by Simmons Bank.

-

{102} Debit Card Fraud Alerts Program: All Simmons Bank debit card accounts are automatically enrolled in the real-time Fraud Alerts Program and are being actively monitored. If fraudulent charges are suspected, the cardholder will receive an introductory text message from Simmons Bank that offers the opportunity to opt out of future alerts. It is the cardholder's responsibility to keep contact information current. Messaging frequency depends on account activity. For more information, text HELP to 32874. To cancel fraud text messaging services at any time, reply STOP to any alert from your mobile device. For Fraud Alerts support, call 1-866-795-9410. By giving us your mobile number, you agree that Fraud Alerts text messaging is authorized to notify you of suspected incidents of financial or identity fraud. Release of Liability: Alerts sent via SMS may not be delivered if phone is not in range of a transmission site, or if sufficient network capacity is not available. Even within coverage, factors beyond the control of the carrier and for which the carrier is not responsible may interfere with message delivery.

-

{213} Early Payday applies to direct deposit and other Automated Clearing House (ACH) deposit transactions, and is dependent on when the payer’s payment instructions are received by Simmons Bank. Simmons Bank will generally make funds from these deposits available the same day payment instruction is received or two days before the listed effective date of the payment, whichever is later. Simmons Bank reserves the right to terminate or change this practice without any notice to you and to place any restrictions or limits Simmons Bank deems necessary.

-

{181} No minimum balance required at account opening. A minimum of $0.01 required within 45 days of account opening. Accounts not funded within 45 days of opening will be closed. Account currently only available to residents of Arkansas, Kansas, Missouri, Oklahoma, Tennessee and Texas. Applying for joint ownership or adding beneficiaries may be completed by visiting a Simmons Bank branch. Must be 18+ to open. Must be opened online.

-

{201} Receive 0.25% over the Coin Savings account’s base interest rate when Relationship Premium A requirements are met or 0.50% over the Coin Savings account’s base interest rate when Relationship Premium B requirements are met. Relationship Premium A requirements: (i) have at least one linked Coin Checking account, and (ii) make a combined minimum of 15 purchase transactions (ATM and other cash withdrawal transactions are excluded), using debit card(s) of the linked Coin Checking account(s), that settle and post to the account(s) on or before the last business day of the month preceding the end of the Coin Savings account statement cycle to which the Relationship Premium will apply. Relationship Premium B requirements: (i) meet both Relationship Premium A requirements, and (ii) have a combined minimum of $500 in ACH transactions deposited into your linked Coin Checking account(s) that settle and post on or before the last business day of the month preceding the end of the Coin Savings account statement cycle to which the Relationship Premium will apply. To be linked, a Coin Checking account must have the same primary account holder as the Coin Savings account. Relationship Premiums will only be paid on Coin Savings account balances up to and including $10,000. Any remaining balances in the account will be paid the base interest rate. Pending transactions are not settled and posted. Only one Coin Savings account per account holder may be eligible for Relationship Premiums; if you have multiple open Coin Savings accounts, Relationship Premiums will only apply to the most recently opened account. Your Coin Savings and Coin Checking accounts are subject to other terms and conditions.

-

{21} Available for personal accounts only.

-

{16} Data connection required. Wireless carrier fees may apply. Mobile deposit is available to Simmons Bank online and mobile banking customers who are at least 18 years of age and have the most recent Simmons Bank App for iPhone®, iPad®, or Android™.