Fraud education

Scammers target everyone, including you.

Use this page to learn how to keep your financial information safe and to better acquaint yourself with the tools at your disposal when banking with Simmons.

![]()

Business email compromise

Business email compromise refers to the act of cybercriminals gaining access to a business email account and masquerading as the account owner to help their fraudulent emails appear legitimate. One of the most common tactics is fraudulent wire transfers. Cybercriminals send emails to employees who can access a company’s funds and request transactions like wire transfers or ACHs. In other instances, a cybercriminal might contact a worker who has access to employee information, such as a payroll or human resources associate, hoping to gain personal data to perpetuate identity theft.

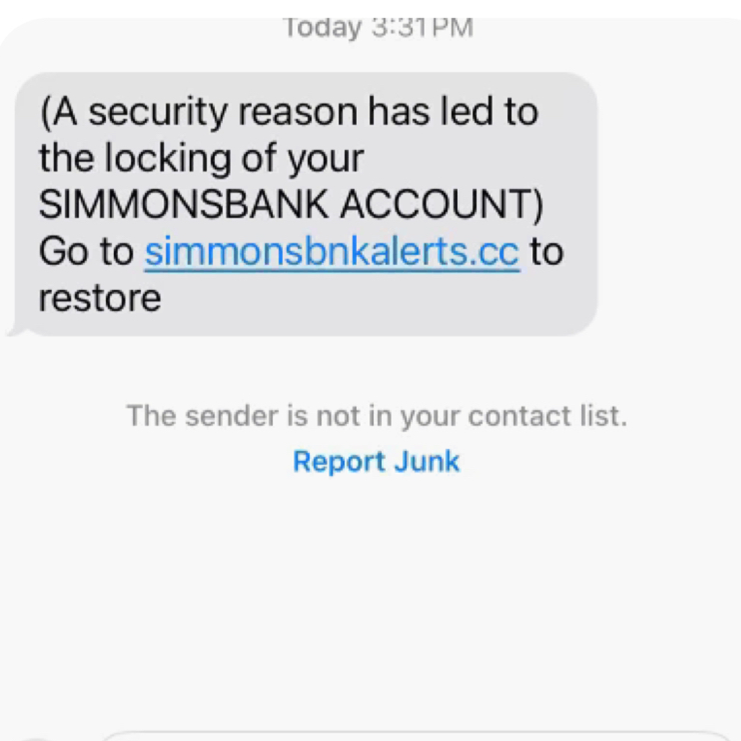

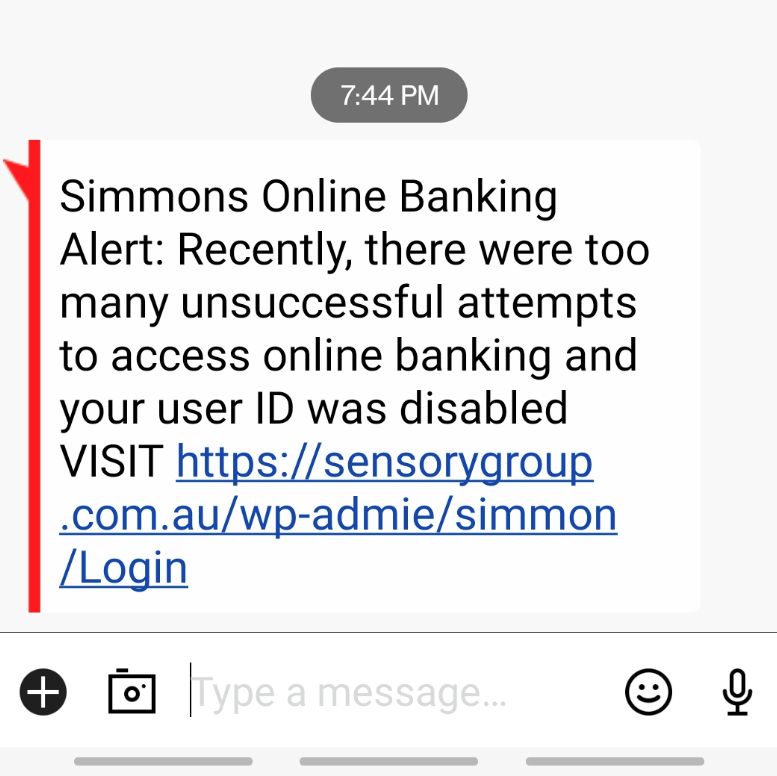

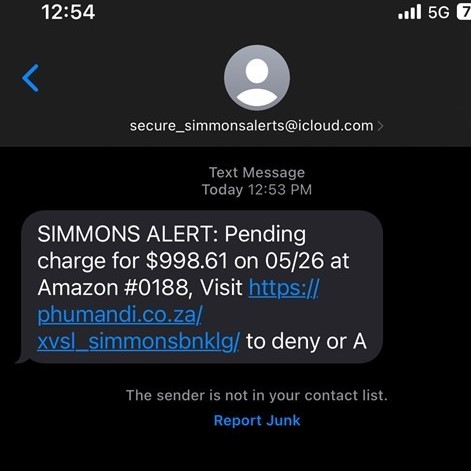

Text Scams

We have received reports of suspicious text messages and emails impersonating Simmons Bank. These messages may include requests for information such as account number, debit card number, online and mobile banking passcode and Social Security Number. This is a series of text scams being used to gain access to private information. Do not click any links, do not call the phone number provided in the message, do not reply to any text messages and do not provide any of your personal information.

Here are a few examples of recent text scam attempts.

Simmons Bank will only ask you to repeat a one-time passcode when the message clearly states to provide the code to the support representative. If the message does not instruct you to provide the code, do not provide any information.

If you have already provided your personal information in response to this scam, please contact Simmons Bank Customer Care at 1-866-246-2400.

-

{192} Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.